Baron Rothschild? Anselm Rothschild? Nathan Mayer Rothschild? Lionel de Rothschild? Bernard Baruch? John D. Rockefeller? Apocryphal?

Question for Quote Investigator: Societal chaos and violence is frightening to investors. Uncertainty depresses the prices of securities. Yet, a popular adage highlights the presence of opportunity:

Buy when blood is running in the streets.

This guideline makes sense if property rights are maintained and the market recovers. This statement has been credited to a member of the Rothschild family of bankers. A more elaborate version states:

You must buy when blood is running on the streets — even when it’s your own.

Would you please explore this topic?

Reply from Quote Investigator: The earliest match found by QI appeared in “The Globe” newspaper of Toronto, Canada on December 29, 1893. The following passage referred to “rentes” which were bonds issued by the government of France. Boldface added to excerpts by QI:1

A French investor at a critical time was advised by one of the Rothschilds to buy rentes.

“What!” he cried. “Buy Government securities while the streets of the capital are running with blood?”

“My friend,” was the reply, “if the streets were not running with blood you couldn’t buy rentes at present prices.”

The passage did not precisely identify the member of the Rothschild family who offered the advice. Also, the historical event that precipitated the violence was not specified.

This early anecdote did not directly present a compact proverb. The statement above which was similar to the modern proverb, was formulated as a question not an adage. Nevertheless, over time this anecdote evolved to yield the proverb.

Below are additional selected citations in chronological order.

The gruesome depiction of the streets of Paris running with blood has a long history. For example, in 1792 an article in an Irish newspaper about the French Revolution said the following:2

It was they who planned and directed the execution of those dreadful scenes which made the streets of Paris run with blood during the first week of September, and which still excite horror in the most distant departments.

The proverb under examination is often linked to a more recent event. The Paris Commune was a revolutionary government that seized power in Paris in March 1871. It was suppressed by May 1871.

On January 1, 1894 “The Chicago Daily Tribune” printed a piece containing the anecdote about buying securities in a distressed market. The market was agitated because of the Paris Commune:3

It is related that in the old days of the Commune in Paris a panic-stricken investor turned up in the office of M. de Rothschild and exclaimed:

“You advise me to buy securities now. You are my enemy. The streets of Paris run with blood.”

And Rothschild’s answer was this: “My dear friend, if the streets of Paris were not running with blood do you think you would be able to buy at the present prices?”

The moral of that is applicable now. Everybody is downcast, everybody hopeless, everybody fearful that the bottom is about to drop out of everything. People who buy now are brave.

Unless all precedents fail their bravery will bring profit.

On the same day, “The Kansas City Star” of Missouri published the same anecdote although the phrasing was slightly different:4

A French investor at a critical time was advised by one of the Rothschilds to buy rentes.

“What!” he cried. “Buy government securities while the streets of the capital are running with blood?”

“My friend,” was the reply, “if the streets were not running with blood you couldn’t buy rentes at present prices.”

On January 21, 1894, the following version of the anecdote appeared in “The New York Times”:5

… they tell in Wall Street the story of old Baron Rothschild, who, in the time of the Paris Commune, having advised a friend to buy French rentes, was criticised by a customer, who declared that it was foolish to think of making such investments while the streets of Paris were running with blood, to which the famous financier responded: “But, my friend, you could never buy at anything like these prices if the streets were not filled with blood.”

In 1910 “Munsey’s Magazine” of New York printed a version of the tale in which the sewers of Paris were running red with blood. A friend asked Baron Rothschild what he was doing in response to Paris Commune:6

“Why,” replied the famous banker musingly, “rentes are selling at sixty-five. I bought five millions yesterday.”

“What!” exclaimed the other. “Bought rentes? Why, France is without a government, and the sewers of Paris are running red with blood!”

“Yes, it is deplorable,” remarked the baron, “but if the sewers of Paris were not running red with blood, I could not buy rentes at sixty-five. France will survive this terrible calamity, as she survived the Revolution, and the seven coalitions against her of all the powers of Europe. Her credit will again be the highest of any nation, and rentes will sell again above par.”

In 1916 the “Weekly Market Letter” of Thomas Gibson in New York City printed the anecdote and asserted that the advice giver was Anselm Rothschild who lived between 1803 and 1874:7

It is a most simple and elemental truth that it is because of adverse conditions or prospects that we can buy stocks to advantage. The axiom dates back to Anselm Rothschild, who advised a friend to buy French rentes. “But the streets of Paris are running with blood,” protested his astonished friend. “That,” replied Rothschild, “is why you can buy rentes at these prices.” But simple as the proposition is it is impossible to convince any considerable number of people of its validity.

The anecdote was transformed into a compact proverb in 1942 when journalist George T. Hughes of the North American Newspaper Alliance wrote the following:8

Prices of the leading rubber company stocks have given a good demonstration of the Rothschild investment dictum to “buy when the streets run with blood.” The rubber stocks had their blackest hour when the Japanese military machine rolled over Malaya and the Netherlands East Indies and other areas producing some 90 per cent of the world’s crude rubber. Since then a few of them have doubled in quoted value …

In 1964 another instance of the proverb appeared in the book “Bear Markets: How to Survive and Make Money in Them” by Harry D. Schultz:9

Someone recently said COURAGE is a vital need in the market. To be a successful investor you must have extraordinary courage. You must be fully invested when the majority are afraid to venture. You will be in cash when the unsophisticated are buying their heads off. Bear markets seem to require an extra measure.

Rothschild once advised, “Buy when the blood is running in the streets.” He said it all.

In September 1964 a columnist in “The Guardian” newspaper of London printed an instance of the proverb:10

The Rothschild dictum of “buy when the blood runs in the streets” will be regarded as too extreme by most small investors; but buying opportunities should always be considered when a promising economic situation is superimposed on a sombre or doubtful political background.

In June 1965 a newspaper in Salisbury, North Carolina attributed the proverb to an anonymous tycoon:11

Another Wall Street tycoon said the time to buy “is when blood is running in the streets.”

In 1973 the “Boston Sunday Globe” of Massachusetts published an article which attributed the saying to Lionel de Rothschild who lived between 1808 and 1879. The newspaper misspelled “Rothschild” as “Rothchild”:12

Lord Lionel Rothchild, in his grisly but straightforward way, once said that “the time to buy is when the streets are running with blood.”

In 1980 a syndicated columnist attributed the saying to U.S. financier Bernard Baruch:13

The financial wizard Bernard Baruch said, “Buy when there’s blood in the streets.” That’s what’s happening in the real estate sales industry now.

In 1987 James Dale Davidson and William Rees-Mogg published “Blood in the Streets: Investment Profits in a World Gone Mad” which contained the following epigraph:14

The best time to buy is when blood is running in the streets.

— Nathan M. Rothschild

Nathan Mayer Rothschild lived between 1777 and 1836. According to the book, Rothschild bought securities in the depressed London market in 1815 when many feared that Napoleon would defeat the Duke of Wellington at the Battle of Waterloo. The market soared when traders learned about the triumph of the Duke of Wellington:15

This story illustrates the Rothschild principle from which the title of this book is taken: “The best time to buy is when blood is running in the streets.” It is a principle that is true today. The greatest profits can always be had by buying when prices are most depressed by pessimism.

In 1990 quotation collector Robert Byrne attributed the saying to a famous U.S. businessman who died in 1937:16

The way to make money is to buy when blood is running in the streets.

John D. Rockefeller (1839-1937)

In October 1994 the “Chicago Tribune” printed an extended version of the adage. This was the first match for the extended version found by QI:17

“I love market crashes, panic. As one of the Rothschilds once said, you must buy when blood is running on the streets — even when it’s your own.”

Mark Mobius, head of the emerging-markets team at Templeton Investment Management.

In 2009 the extended version of the proverb appeared in a Carlsbad, New Mexico newspaper:18

Some of the legendary investors would tell you that when pessimism is at its peak, is when optimism comes in. The quote most often quoted is by the Baron Rothschild, “Buy when there’s blood in the streets, even if the blood is your own.”

In conclusion, this proverb was derived from an anecdote which appeared in 1893. This anecdote was retold in 1894 with additional details; the setting was the Paris Commune of 1871. This long delay reduced the credibility of the anecdote. In addition, early versions of the anecdote did not specify a precise member of the Rothschild family.

The dialogue of the anecdote was converted into a proverb in 1942 by financial journalist George T. Hughes. The extended proverb which referred to “your own” blood emerged in 1994.

In 1916 the tale was implausibly linked to Anselm Rothschild. Later citations named Lionel de Rothschild and Nathan Mayer Rothschild. But QI believes that none of these citations is convincing. Overall, based on current evidence QI considers this anecdote to be apocryphal.

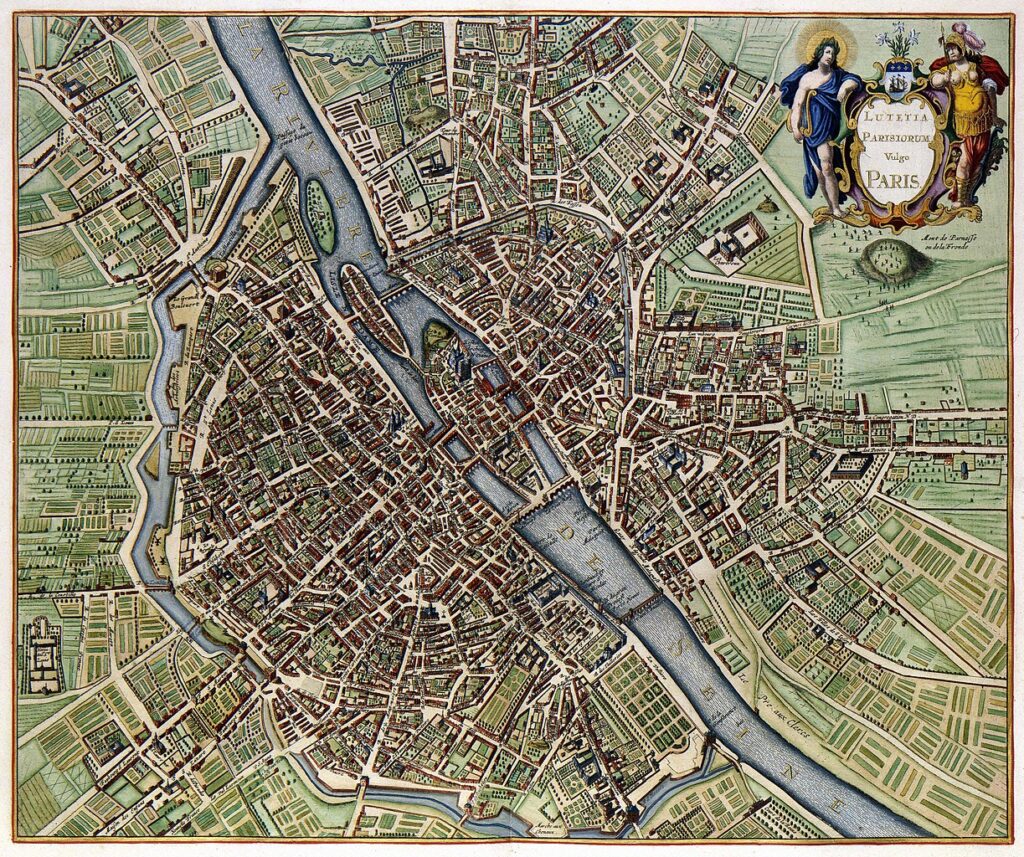

Image Notes: Map of Paris published in 1657 by Dutch cartographer Jan Janssonius. The map was accessed via Wikipedia.

Acknowledgement: Great thanks to Jason Zweig whose inquiry led QI to formulate this question and perform this exploration. Special thanks to pioneering researcher Barry Popik who found helpful citations beginning on January 1, 1894. Also, thanks to “The Dictionary of Modern Proverbs” which contained an entry for this proverb with citations beginning in 1964.

- 1893 December 29, The Globe, Finance and Commerce, Quote Page 7, Column 1, Toronto, Ontario, Canada. (Newspapers_com) link ↩︎

- 1792 November 8, The Waterford Herald, Foreign Intelligence: France, Quote Page 1, Column 4, Waterford, Waterford, Ireland. (Newspapers_com) ↩︎

- 1894 January 1, The Chicago Daily Tribune, Rothschild Prophecy Exceeded by H. Allaway, Quote Page 12, Column 2, Chicago, Illinois. (Newspapers_com) link ↩︎

- 1894 January 1, The Kansas City Star, Rothschild’s Long Head, Quote Page 4, Column 6, Kansas City, Missouri. (Newspapers_com) ↩︎

- 1894 January 21, The New York Times, Business’s Bright Outlook, Start Page 1, Quote Page 2, Column 1, New York, New York. (Newspapers_com) ↩︎

- 1910 September, Munsey’s Magazine, Volume 43, Number 6, Financial Department by John Grant Dater (Special Representative of the Munsey Publications), Stocks and Bonds at Attractive Prices, Quote Page 871, The Frank A. Munsey Company, New York. (Google Books Full View) link ↩︎

- 1916, Weekly Market Letter – Thomas Gibson, Date of Weekly Letter: February 25, 1916, Quote Page 2, Column 1 and 2, Broadway, New York City. (HathiTrust Full View) link ↩︎

- 1942 December 19, The Springfield Daily Republican, Hard-Hit Rubber Trade More Than Holding Its Own by George T. Hughes, Quote Page 11, Column 4, Springfield, Massachusetts. (Newspapers_com) link ↩︎

- 1964 Copyright, Bear Markets: How to Survive and Make Money in Them by Harry D. Schultz, Chapter 16: Human Psychology in the Market Place, Quote Page 164, Prentice-Hall Inc., Englewood Cliffs, New Jersey. (Verified with scans) ↩︎

- 1964 September 30, The Guardian, Company earnings prospect versus the political snags by Mercury, Quote Page 13, Column 4, London, England. (Newspapers_com) ↩︎

- 1965 June 27, Salisbury Sunday Post, Editorial: No Cause for Panic, Quote Page 2C, Column 1, Salisbury, North Carolina. (Newspapers_com) ↩︎

- 1973 June 24, Boston Sunday Globe, Lack of investment adds to Northern Ireland’s woes by Dan Rosen (Special to the Globe), Quote Page A-90, Column 3, Boston, Massachusetts. (Newspapers_com) ↩︎

- 1980 December 7, The Saginaw News, ‘Blood in streets’ means now is time to buy a house by Robert J. Bruss (Syndicated), Quote Page F2, Column 1, Saginaw, Michigan. (Newspapers_com) ↩︎

- 1987 Copyright, Blood in the Streets: Investment Profits in a World Gone Mad by James Dale Davidson in collaboration with Sir William Rees-Mogg, (Epigraph of book), Quote Page 14, Summit Books, New York. (Verified with scans) ↩︎

- 1987 Copyright, Blood in the Streets: Investment Profits in a World Gone Mad by James Dale Davidson in collaboration with Sir William Rees-Mogg, Chapter: Introduction, Quote Page 17, Summit Books, New York. (Verified with scans) ↩︎

- 1990, The Fourth and By Far the Most Recent 637 Best Things Anybody Ever Said Compiled by Robert Byrne, Quotation Number 301, Atheneum: Macmillan Publishing Company, New York. (Verified with scans) ↩︎

- 1994 October 28, Chicago Tribune, Think about it, Section 3, Quote Page 3, Column 1, Chicago, Illinois. (Newspapers_com) link ↩︎

- 2009 April 14, Carlsbad Current-Argus, Commentary: Is winter over? by Boz Green, Quote Page 7A, Column 1, Carlsbad, New Mexico. (Newspapers_com) ↩︎